“I wish you enough sun to keep your attitude bright no matter how gray the day may appear.

I wish you enough rain to make you appreciate the day even more.

I wish you enough happiness to keep your spirit alive and everlasting.

I wish you enough pain so that even the smallest joys of life may appear bigger.

I wish you enough gain to satisfy your wanting.

I wish you enough loss to appreciate all that you possess.

I wish you enough hellos to get you through the final goodbye.”

Bob Perks—Chicken Soup for the Grieving Soul 2003

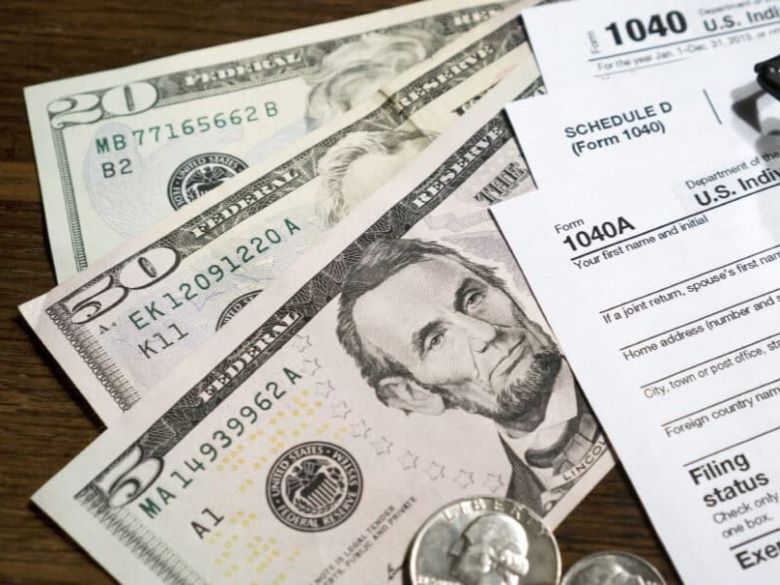

I made the decision long ago to live within my means. After my bankruptcy in 1996, I decided I was never going down that road again.

I didn’t know anything about tithing at that point, but I did know a thing or two about budgeting. When you are living on public assistance, and only have about $20 a week to feed a family of four, you know exactly how many cans of tomato soup that will buy.

Somewhere along the line, I learned the 10-10-80 principle. How this works is that whenever you get paid, you tithe the first 10% (or give it to charity, if you don’t have a home church), save the next 10%, and live off the remaining 80%.

This is scary when you’re poor.

If 100% of your paycheck isn’t enough to get by, how are you going to do it on 80%?

What I have learned, as I elaborated in Part 2 of this series, is that when you keep your priorities in the proper order, you’ll always have enough. We never ate fancy, but we never went hungry. We could always keep at least one car running and one utility connected. In short, we learned how much “enough” really was.

However, it’s one thing to have black numbers at the end of your monthly budget. It’s quite another to be OK with the black number, no matter how small it is. As Paul said to the Philippians:

I am telling you this, but not because I need something. I have learned to be satisfied with what I have and with whatever happens. I know how to live when I am poor and when I have plenty. I have learned the secret of how to live through any kind of situation—when I have enough to eat or when I am hungry, when I have everything I need or when I have nothing. Christ is the one who gives me the strength I need to do whatever I must do. Philippians 4:11-13 (ERV)

Content, whatever the circumstances.

Our circumstances change, and they are almost always beyond our control. Contentedness, however, is an attitude that we can cultivate and apply to any situation. It is the attitude that whatever we have, it is always enough.

If we are able to develop this attitude when we don’t have much, then God begins to trust us with more. For this reason, He requires contentedness as a condition of stewardship. When we are content with what we have, we are not tempted to gain more by dishonest means. As Jesus cautioned us:

If you are faithful in little things, you will be faithful in large ones. But if you are dishonest in little things, you won’t be honest with greater responsibilities. And if you are untrustworthy about worldly wealth, who will trust you with the true riches of heaven? Luke 16:10-11 (NLT)

Have you ever wondered why so many TV evangelists and prosperity gospel hucksters end up disgraced? It’s this principle at work. They are not content with what they have been given, so they take the Lord’s name in vain by using it to cheat people and build up their own treasures on earth. Their messages end up as corrupted as their hearts, and NO ONE gets blessed.

Faithfulness and Integrity

So, what does it look like to manage your money with faithfulness and integrity? There are many examples, but here are six that I am currently trying or have already had success with:

- Avoid get-rich-quick schemes. I went into detail about this in Part 1. This is what led to the bankruptcy I mentioned in the opening paragraph.

- Save gradually. Have a goal amount ($1,000 is a good place to start), but don’t obsess about the date. Getting there is more important than WHEN you get there.

- Employ the debt snowball method. Although logic might suggest that you pay down your accounts with the highest interest rate first, if you are drowning in debt, you have a psychological need to see progress. The debt snowball method (aka the Avalanche method) involves paying off your smallest debt first, while making minimum payments on your other accounts. Then, when the smallest account is paid off, take the amount you were paying on that and add it to the minimum payment on your next largest account. As you continue this process, you will gain momentum, and your accounts will STAY paid off.

- Use a cashback credit card like a debit card. (NOTE: IF YOU HAVE GOTTEN INTO TROUBLE WITH CREDIT CARD DEBT DUE TO LACK OF DISCIPLINE IN THE PAST, PLEASE ACKNOWLEDGE YOUR LIMITS AND SKIP THIS STEP.) We chose the Quicksilver card from Capital One, but there are other cards that might be more beneficial based on your individual spending patterns. We pay for EVERYTHING on this card, then pay the balance in full each month, so that we do not ever pay interest on it. With every purchase, we get 1.5% cash back. This doesn’t sound like much, but we let that bonus cash accumulate and have Capital One send us a check on the first of November, which then becomes our Christmas Fund. This year, the check was for $703.59. (Note—many restaurants are now applying a service charge for paying by credit that is higher than the 1.5% cash back bonus. If this is the case, then see #5 immediately below.)

- Pay cash for everything. Once you have completed step 3, paying down all your debts, don’t make new ones. Pay cash for everything you get (or use the cashback credit card from step 4). If you don’t have enough cash right then for a large purchase, a car for instance, wait until you do, or find another way to leverage your income (or add to it). If contentedness is your priority, this will prove easier than you might think. We made our last car payment on September 5, 2013—ten years ago this month! We have paid cash for a newer car since then.

- Set an example for your children. The first five steps are of little use unless you pass on the wisdom to your children. They understand more than you might think. Don’t insult them by withholding the concept of money management until they are “old enough to handle it.” The danger you are courting there is that your children will develop an attitude of entitlement, rather than contentment, which can become hard-wired into their personalities long before they ever learn what a spreadsheet is.

Blessed to be a Blessing

I have learned what it is to have enough, and to recognize when I have been blessed with more than enough, which is pretty much all the time.

And we are blessed to be a blessing, so that everyone has enough. This goes much deeper than wealth distribution, which the government can handle. This is about an attitude in the heart of every individual by which we can find joy in our circumstances, whatever they may be.

Therefore, dear readers, I wish you enough.

(Tomorrow is National Good Neighbor Day! I’ll have something special for you. Make sure to click on Free Newsletter so you don’t miss it!)